The banking industry is undergoing tremendous transformations. Financial services, internal procedures, and most crucially, the customer experience are being changed by digital transformation and new technology.

Employees should be motivated with opportunity, and then rewarded for their achievements. Employees now seek challenge, recognition, and progress as Millennials form the majority of the workforce. Employees must be provided with regular opportunities and different innovative ways to gain skills that will either get them promoted or prepare them for a different career entirely.

A Learning Management System such as Kapture’s in regard to banking can help the banking sector in making the training fun and interesting for the employees. Automated reporting and analytics in the banking LMS helps the management to track the progress and reward the employees.

What is the need for a Learning Management System in the banking sector?

Innovating new goods, procedures, and laws are all issues that have a direct impact on employee training and need the use of agile approaches. Companies are able to adjust to changes in this manner, allowing them to empower staff at any time, quicker, and more efficiently.

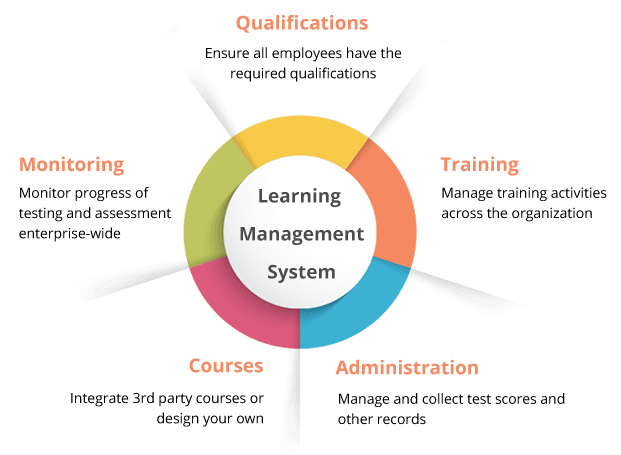

Source- Benefits of Learning Management System

LMS in banking can benefit in the following ways-

1. Organized and planned training sessions

Managing and organizing training sessions can be a hectic job. Learning Management System helps managers seamlessly keep track of all the training sessions going on in your organization. All the learning data can be centralized to a unified LMS platform.

You may identify learner groups and skill development requirements across businesses, as well as organize your training objectives, target outcomes, material, resources, instructors, timetables, and track progress in one location.

2. Personalized learning and training for everyone

Every employee working in the banking sector works in different departments and needs to be trained and educated in different ways.

The Learning Management System in banking helps you to categorize groups of people in different departments. It allows you to prepare different types of training materials like articles, training videos, presentations, quizzes, etc for different sets of employees according to their requirements.

A learning management system may provide you with tools that allow you to simply develop customized learning routes or even outsource material and integrate it into training, making your job easier while maintaining quality.

3. Retain and engage more employees

Searching for good employees is a tough job, why not retain the good ones that you already have? Losing your best-selected employees due to poor training processes can be painful for the banking industry.

Training becomes rather sophisticated and begins to seem more like a chore beyond a certain point, which causes the learning program to lose engagement and information retention for those who continue to stick around.

The easiest approach to increasing these numbers is to use an LMS to make your course more engaging. Incorporate award-based microlearning so that learners see it as a goal to stay motivated.

4. Reduction in time and cost

Primitive manual training methods can be boring and time-consuming. It is possible to bypass the burden of planning classroom-based training entirely.

Professionals may attend self-paced courses and bite-sized training modules offered on a cloud-based learning management system for banks at any time. A lot of time, money, and travel may be saved in a competitive business like banking.

It saves time by allowing your staff to train at a time that is convenient for their schedule. There is no longer a need to disrupt processes to hold in-person training sessions.

5. Tracking progress

It is important to keep a track of your employees’ progress and reward them for their efforts. LMS in banking comes with features such as reporting and analytics that creates regular performance reports of your employees’ training.

The tracking enables authorities to understand their employees’ efficiency as well as their weak places, ensuring that the appropriate resources are available to bridge such skill and knowledge gaps.

In the banking and financial business, it is critical that each employee progresses on an individual level, which is guaranteed by providing tailored training based on monitoring information.

6. Promotes consistency and transparency

When training is offered through an LMS, it tends to become more uniform across locations, departments, and operations. Common material, well-thought-out objectives, and methods for evaluating training outcomes all contribute to increased responsibility across the board.

All metrics are made more accessible. Managers and decision-makers may track the success of their employees.

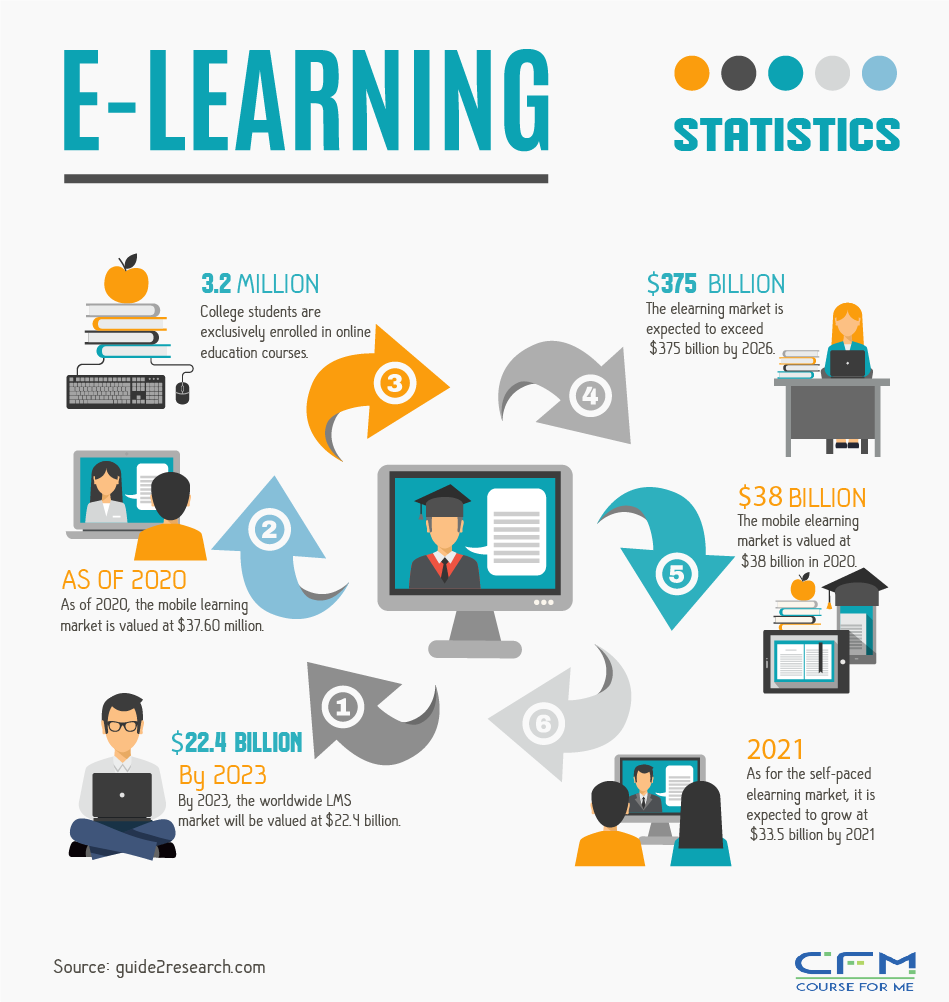

Source- Importance of Elearning and KMS

Kapture + Learning = Fun

Kapture’s Learning Management System can help the banks streamline their training process and make it more efficient and fun. It ensures your support team members are up-to-date with company protocols, policies, and how-to guides by conducting regular tests and assessing their performance.

It also lets your team access any required data from anywhere, at any time. Store all the updated manuals, guidelines, policies, and team-wise instructions on LMS.

Using custom reports, identify the team members who are performing well and the staff members that require further training. Motivate your team by rewarding star performers.

Implement Kapture’s LMS system for a simplified and easy training process.

About the Author | |

| Ankit Kochar |

| Ankit Kochar is a content writer at Kapture CRM who loves to write creative as well as informative content. He has worked as a creative and academic content writer in the past and has a keen knowledge of writing reports, essays and dissertations. His current field is helping him research and hone his SaaS knowledge. | |

,

,

,

,

,

,

,

,

,

,

,

,

,