TL;DR

Customer Lifetime Value reflects the total revenue a business is likely to earn from a customer over the course of the relationship. As customers continue purchasing and remain with the business longer, retention becomes closely tied to long-term revenue and profitability.

- A consistent experience and fewer repeated support issues usually make it easier for customers to continue the relationship.

- Messages tied to recent activity are more likely to hold interest than one-off promotional outreach.

- Loyalty programs add the most value when they’re backed by ongoing communication that keeps the relationship from going quiet after checkout.

Some customers make a single purchase and never return. Others stay for years, buy repeatedly, and become far more valuable over time. Customer Lifetime Value (CLV) captures this difference by measuring how much revenue a customer generates across the full length of the relationship.

Looking only at how many new customers sign up leaves out a lot. Teams also want to understand how long customers stay, how often they return, and what keeps them involved.

The results are hard to ignore. Forrester’s 2024 US Customer Experience Index shows that companies prioritizing customer experience achieved 41% faster revenue growth, 49% faster profit growth, and 51% higher customer retention compared with others.

CLV helps teams see how routine experience decisions affect revenue over time. From this perspective, it becomes easier to review personalization efforts, proactive service, and loyalty programs and see where changes are needed.

This blog covers what CLV represents, how it’s calculated, and how retention influences it over time.

What Is Customer Lifetime Value (CLV)?

Customer Lifetime Value measures the revenue that is built from a customer over time. The focus is on total contribution, not isolated purchases.

At a basic level, CLV depends on three core factors –

- How much does a customer spend per purchase?

- How often do purchases occur?

- How long does the customer relationship last?

Many businesses refine this calculation by including service, support, and operational costs to determine net CLV. A customer may generate high revenue, but frequent support requests or heavy discounting can reduce their actual long-term value.

CLV is commonly measured using two approaches –

- Historical CLV, which looks at the value a customer has already generated

- Predictive CLV, which estimates future value using past behavior and engagement patterns

Historical CLV helps teams evaluate past performance. Predictive CLV is often used when teams are planning ahead, especially around retention priorities and resource use.

Customer behavior viewed alongside revenue over time adds context to how relationships differ.

Why Is Customer Lifetime Value Important?

Customer Lifetime Value considers customer relationships alongside revenue and profit. It takes a longer view than short-term sales by considering repeat activity over time.

1 . Linking Customer Behavior to Revenue

CLV shows how regular customer actions translate into revenue. Repeat purchases and ongoing usage reveal which relationships matter most over time, offering more insight than isolated sales numbers.

2. Guiding Retention and Acquisition Decisions

Lifetime value gives companies a reference point for acquisition spend without putting profitability at risk. It also helps teams make clearer calls on where to focus retention work, which segments to engage more deeply, and where added support actually matters.

3. Revealing the Impact of Loyalty and Experience

Customers with higher lifetime value tend to stick around. They buy more often and usually spend more as the relationship continues. Usually, it just means customers are comfortable staying. They recommend the brand, and they are willing to try something new without much hesitation.

4. Improving Resource Allocation and Forecasting

CLV helps teams decide what is worth focusing on long-term. It also leads to more realistic forecasts by using existing customer behavior as the baseline.

Customer Lifetime Value Formula: How to Calculate CLV

CLV is worked out using a formula that reflects customer behavior over time. The focus stays on purchasing patterns and relationship length, not assumptions.

1. CLV Formula Breakdown

The most commonly used formula for calculating CLV is –

CLV = Average Purchase Value × Purchase Frequency × Customer Lifespan

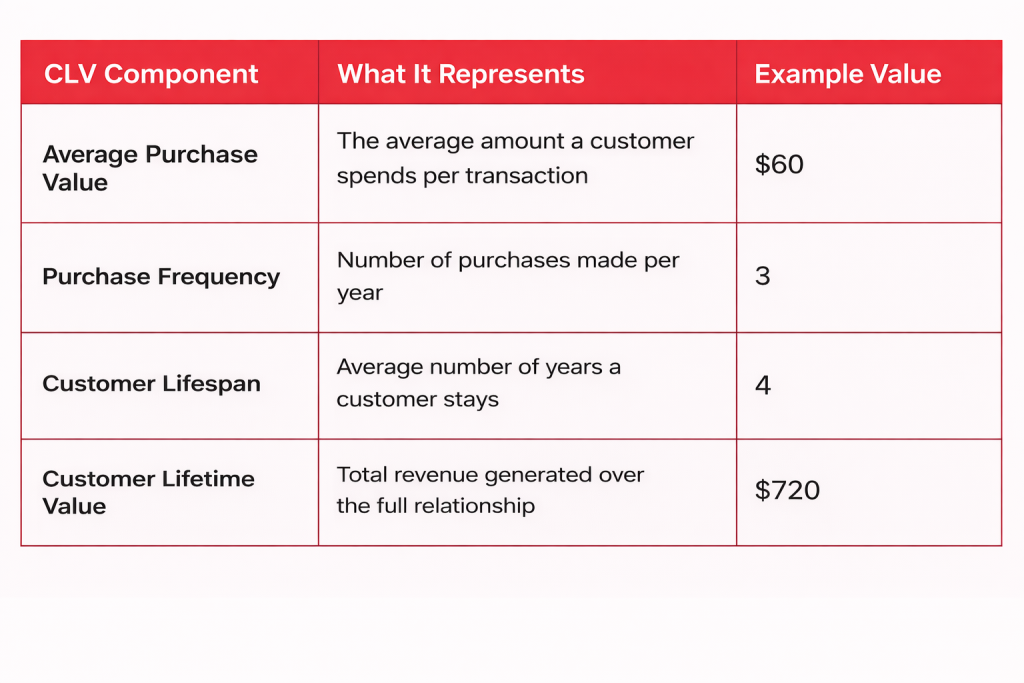

Each part of the formula represents a specific aspect of customer behavior –

- Average purchase value refers to how much a customer spends on a typical transaction

- Purchase frequency shows how often customers make a purchase in that same period

- Customer lifespan reflects the average length of time customers continue purchasing before they stop.

When the three values are multiplied together, the result is used as an estimate of total revenue from a customer over time.

2. Practical CLV Example

Consider a simple example –

Using the formula –

CLV = $60 × 3 × 4 = $720

In this case, the average customer generates $720 in revenue over their time with the business.

This figure sets a baseline. Teams can then decide how much investment makes sense across acquisition, retention programs, and customer experience work.

Examples of Customer Lifetime Value in Action

CLV makes more sense when applied to real scenarios. Many companies use it to guide retention strategies and support long-term revenue by looking at how customers behave over time.

1. Subscription Businesses That Reduce Churn

Subscription models rely on retention to drive lifetime value. Netflix often comes up in churn discussions. Monthly churn is commonly estimated at 1–3%. That gives customer relationships more time to develop and increases total revenue per subscriber.

Usage patterns matter here. Content suggestions appear quickly. Discovery stays familiar. Engagement stays steady. Customers who leave sometimes return.

2. Improving CLV Through Better Customer Experience

Customer experience also plays a direct role in lifetime value. Wow Skin Science, a consumer brand, improved retention-related outcomes by centralizing customer conversations and speeding up support responses using Kapture CX.

The brand reduced repeat support interactions by 80% and achieved service levels above 90%, making it easier for customers to resolve issues quickly and continue purchasing over time.

3. Ecommerce Ecosystems That Expand Customer Value

Amazon Prime takes a bundled approach. CIRP data places U.S. Prime members’ spending at roughly $1,100–$1,200 annually, more than double that of non-Prime customers. Delivery speed and added services support frequent purchases.

4. Long-Term Value in Financial Services

In financial services, CLV grows as customers maintain longer relationships and adopt additional products. McKinsey’s research highlights a pattern around loyalty programs. Customers in paid programs tend to spend more, with spending increases about 60% more likely than in free programs.

How to Improve Customer Lifetime Value (CLV) in CX

Improving Customer Lifetime Value through customer experience comes down to keeping customers engaged for longer and making interactions easy and meaningful.

Below are seven CX-led strategies that directly contribute to higher CLV.

1. Reduce Customer Effort Across High-Impact Journeys

Common customer journeys tend to create the most issues. Onboarding, billing questions, returns, and account changes are usually where problems start to appear. Simplifying these flows by cutting down steps, improving clarity, and resolving issues faster helps customers move ahead without frustration.

2. Eliminate Repeat Issues at the Source

Recurring issues usually signal a deeper problem. Tracking frequent contact reasons and focusing on root causes helps teams avoid solving the same issue repeatedly. Collaboration between CX, product, and operations teams plays a key role here.

3. Prevent Churn With Proactive Support

Customers do not always raise issues right away. Proactive updates and outreach during known risk moments, such as delays or payment failures, help manage expectations early and reduce the risk of churn.

4. Personalize Support Using Full Context

Support conversations tend to go more smoothly when teams already have context. When past interactions and account details are visible, customers do not have to repeat themselves. That alone saves time.

5. Improve Onboarding and Ongoing Enablement

Initial product use is where many patterns form. Clear onboarding and guided setup help customers move forward, while follow-up tips support ongoing usage later on.

6. Make Self-Service Reliable and Useful

Self-service only helps when customers can actually use it. Looking at search behavior and support tickets shows where content falls short. Updating articles and flows with customer language reduces effort and unnecessary agent involvement.

7. Turn CX Feedback Into Action

Feedback is not the goal. The goal is what you change because of it. Combine CSAT, effort scores, quality reviews, and churn signals to identify loyalty patterns. Over time, even modest retention gains can raise lifetime value in a noticeable way.

Measuring Customer Lifetime Value and Key Metrics for CX

A customer’s long-term value comes from time, spend, and acquisition costs taken together. Seeing these factors together clarifies retention trends.

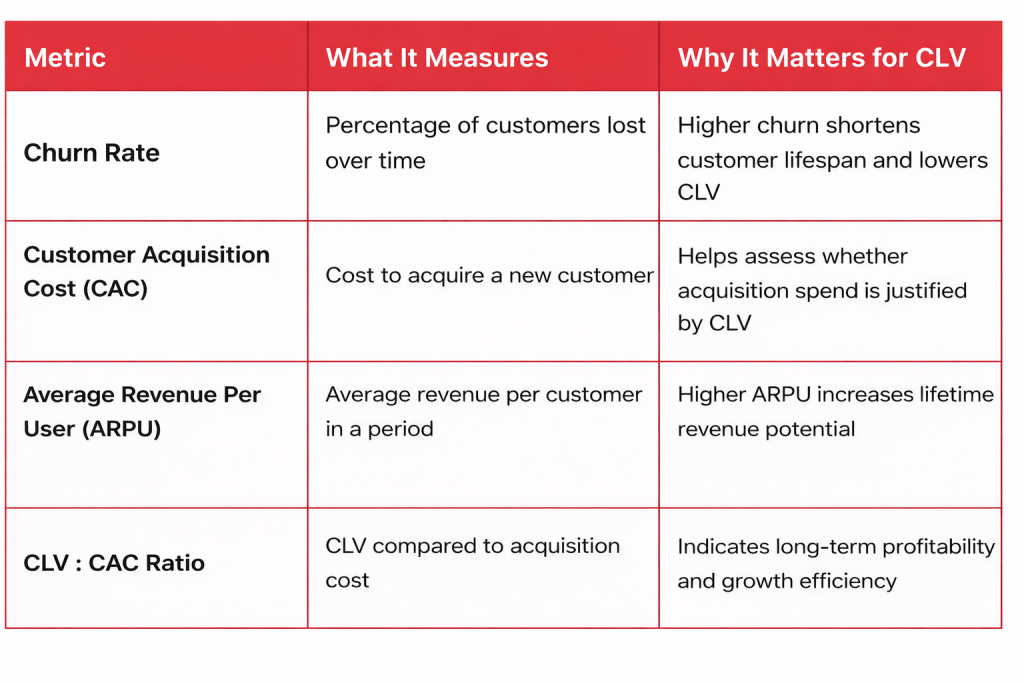

1. Churn Rate

Churn rate measures the share of customers who stop doing business within a set period. It directly affects CLV by determining customer lifespan. Customer relationships tend to be shorter when churn is higher. Customer value generally increases as relationships last longer.

2. Customer Acquisition Cost (CAC)

Customer Acquisition Cost represents acquisition-related spend. It is often reviewed against lifetime value to assess efficiency.

3. Average Revenue Per User (ARPU)

Revenue and active customer counts are commonly referenced through Average Revenue Per User. The measure comes from total revenue and customer counts. ARPU is commonly referenced when estimating future customer value.

The table below outlines how these metrics relate to CLV and why they matter in CX reporting.

Turning Customer Relationships Into Long-Term Value

Customer Lifetime Value reflects how customer relationships develop through repeated interaction over time. Engagement and repeat behavior are considered alongside individual transactions. Resolution speed, repeated issues, and customer context often vary across these relationships.

Platforms like Kapture CX help teams connect customer conversations, experience data, and workflows to better understand what drives long-term value.

If you would like to see how CLV insights can be applied to your CX operations, you can book a personalized demo with Kapture CX and explore it in a practical, hands-on way.

FAQ

Yes. Longer buying cycles shift attention toward engagement, renewals, usage, and support interactions.

Experience issues are often reflected in churn, repeated support needs, or lower usage. These signals typically show up ahead of shifts in lifetime value, giving CX teams an earlier view of potential risk.

No. CLV helps teams focus their effort. Different customer segments are usually supported in different ways, with proactive support reserved for higher-value relationships and self-service used elsewhere.

CLV changes gradually. Early signs often include lower churn and better engagement, with lifetime value improving over time as those gains hold.