Customer experience (CX) is not a monolith. It features several moving parts.

According to PwC, it entails speed, convenience, knowledgeable help, and friendly service for eight in ten consumers. But these elements are just the baseline. Brands need to go beyond to truly stand out.

One way to go about it is through empathy. Empathy is a powerful denominator that connects businesses and customers. And it begins with listening.

After all, operational data alone can’t reveal what your customers actually feel or expect. For that, you need direct input, that is, their voice, in their own words. That’s where customer feedback surveys come in. Gartner found that nearly 80% of growth-focused organizations use surveys to capture CX data and refine service delivery.

But collecting responses isn’t enough. The underlying secret lies in acting on acquired insights. This guide walks you through the process of designing, analyzing, and applying customer feedback surveys. Now convert everyday opinions into actionable intelligence.

What are Customer Feedback Surveys?

A customer feedback survey is a structured tool that captures customer opinions about a product, service, or interaction. It’s a way of lending a voice to your customers.

Customer feedback surveys come in several forms, each serving a distinct purpose within the customer experience landscape.

| Survey Type | Unique Strength | Best Used When | Actionable Outcome |

| Welcome Survey | Gathers early impressions from new customers and sets the tone for the relationship | Immediately after registration or sign-up | Identifies initial friction points and tailors customer journeys |

| Onboarding Survey | Captures early user impressions and challenges | During or after onboarding | Improves guidance and setup flows |

| Customer Satisfaction (CSAT) | Collects how happy customers are with a specific interaction or service | Immediately after a purchase or ticket resolution | Improves agent performance and service delivery |

| Net Promoter Score (NPS) | Assesses overall customer loyalty and willingness to recommend your brand | At defined intervals (quarterly, biannually) | Identifies promoters and detractors; guides retention efforts |

| Customer Effort Score (CES) | Measures how easy it was for customers to complete an action | After a support interaction or process (e.g., returns) | Highlights friction points in workflows |

| Product or Feature Feedback | Gathers focused insights on usability and experience | Post-launch or beta phase | Refines features and informs development |

| Exit / Churn Survey | Uncovers reasons behind customer attrition | At the cancellation or inactivity stage | Informs win-back and retention strategies |

Customer Satisfaction Surveys: The Pulse Check on Loyalty & Service Quality

We’ve discussed various customer feedback survey types in the previous section. Each has its own strengths and applicability. However, CSAT or Customer Satisfaction surveys hold a special place.

For one, you can place them at any stage of the customer journey. It could be after the first interaction or as a retargeting effort. And in doing so, you get a sense of the health of your customer experience. After all, they measure how customers feel about a specific event. This could be a resolved ticket, a successful return, or a recent purchase.

The responses give teams a fast, reliable signal about service quality.

What CSAT actually measures

CSAT asks one focused question: “How satisfied were you with this experience?” Typical responses could be numeric (usually 1–5) or descriptive (satisfied/unsatisfied). That simplicity is its strength. CSAT captures the moment that matters most: the direct outcome of your service.

Benchmarks: what good looks like

Across industries, an average CSAT score typically ranges from 70–85% (SurveyMonkey). Top-performing CX teams push into the mid-80s and beyond. Those numbers vary by sector: retail and hospitality tend to score higher, and complex B2B services may track lower, but should show steady improvement.

Use benchmarks as context, not as the sole target.

How to use CSAT strategically

- Spot immediate issues: Low CSAT after a ticket flags a problem you can investigate quickly.

- Coach and reward agents: High/low scores show what agents should repeat or change.

- Test changes: Compare CSAT before/after a process tweak to see if the change delivered value.

- Segment for nuance: Break CSAT down by channel, product, or customer tier to prioritize fixes.

CSAT is a pulse, not a diagnosis. Read it alongside qualitative feedback and effort metrics to understand why scores move. When you do, CSAT becomes a powerful lever for steady improvement and a motivator for teams who can see the direct impact of their work.

Why Customer Feedback Surveys Matter for CX and Service Teams

Customer feedback surveys are the clearest line of sight into how customers experience your brand. They move teams from assumptions to evidence. Below are the main reasons they matter, and how each delivers real value.

Why They Matter

Surveys translate customer voice into actionable signals. The right signals let teams act faster, prioritize better, and build services that actually work for customers.

| Primary Benefit | How They Help | Quick Fix |

| Detect problems early | Repeated mentions of the same issue (e.g., “slow responses”) turn suspicion into priority | Set alerts for repeated low scores on a single tag or topic |

| Reduce churn and boost loyalty | Listening lowers friction. Customers who see changes based on their feedback are likely to stay and recommend | Target detractors with outreach before cancellation |

| Speed up resolutions | Surveys reveal common root causes. Use those insights to create playbooks, canned responses, and smarter triage rules | Build templated responses for the top 5 complaint types |

| Empower and upskill agents | Feedback shows what works. Share examples of five-star interactions as learning material and coach off low-score cases | Run weekly agent review sessions using anonymized feedback |

| Prioritize investments | When multiple issues compete for attention, survey data tells you which changes deliver the biggest CX lift | Rank fixes by frequency × impact on satisfaction |

How Platforms Change the Game

An omnichannel platform that centralizes feedback makes these benefits scalable. With integrated analytics, teams can route urgent complaints, summarize open text, and trigger workflows automatically. That stops feedback from becoming noise and turns it into momentum.

Real Outcome

When organizations treat feedback as a workflow input, not a report that sits in a monthly slide deck, they close issues faster, improve service consistency, and build credibility with customers. That’s why surveys are not optional tools; they’re core operations for service-led growth.

Who Does This Well

- Apple: The company uses NPS surveys after product purchase to gauge customer satisfaction levels.

- Netflix: They gather feedback using CSAT and CES surveys to improve their content curation and app interface.

- Giva: The brand utilized Kapture’s automated surveys to collect feedback immediately after ticket resolution.

How to Design Effective Customer Feedback Surveys: A Step-by-Step Guide

Designing an effective customer feedback survey is an art and a science. Every choice must map to an objective. Get it right, and the rest falls into place.

Step 1 – Clarify the Objective

Start with one sentence: what decision will this survey inform? Is it to fix onboarding, reduce ticket reopenings, or validate a new feature? If you can’t state the decision, don’t run the survey.

Step 2 – Map the Moment of Truth and Pick the Audience

Define the exact touchpoint you’ll survey. Recent ticket resolution? First week onboarding? Only invite customers who have experienced that moment. Targeting the right audience raises relevance and response rate.

Step 3 – Choose the Metric(s) That Fit the Goal

You’ll have to match the metric to the intent. For example, CSAT for interaction quality, CES for effort, NPS for loyalty, and so on. Use one focused scale question for clarity. Add one short open text for context.

Step 4 – Write Crisp Questions and Sequence Them Logically

Ask one thing per question. Use plain language. Open with the scale item. Follow with a single, optional open prompt like: “What could we have done better?” Avoid double negatives and leading phrasing.

Step 5 – Time it and Pick the Channel

Send the survey at the moment of truth. It could be within 24 hours of resolution for transactional feedback, or a controlled cadence for NPS. Plus, pair it with the right channel. You must pick a channel the customer trusts. For example, in-app for product users, email/SMS for broader audiences.

Step 6 – Pilot, Measure Response, Iterate

Run a small trial. Check completion rates, time to complete, and clarity of open responses. Remove confusing items. Shorter is almost always better.

Step 7 – Discover and Follow Best Practices

Adopt these habits as standard:

- Keep it brief: 1–3 questions for transactional surveys.

- Personalize the intro: Reference the interaction and agent when applicable.

- Use neutral wording: Don’t nudge answers.

- Respect frequency: Limit survey cadence per customer.

- Design mobile-first: Many responses come from mobile.

- Integrate triggers with workflows: Link surveys to ticket IDs and tags.

- Ensure data privacy: Clear opt-out and handling instructions.

Turning Data into Direction: How to Analyze Customer Feedback

Collecting feedback is easy. Turning it into prioritized work is hard. Analysis should be a clear pipeline that flows as follows:

Prepare the Data (Clean and Enrich)

Before analysis, normalize fields. Standardize timestamps, channel labels, product names, and customer segments. Enrich records with metadata: ticket ID, agent, SLA tier, and purchase history. This context lets you slice results meaningfully.

Quantitative Analysis: Trends, Segmentation, Cohorts

Start with the numbers. Track CSAT, NPS, CES over time. Then break those numbers down:

- Segment by channel, product, region, and customer tier to discover hot spots.

- Run cohort analysis to see if changes (e.g., a new script or bot) move the needle for a specific group.

- Correlate metrics with operational KPIs (handle time, resolution rate) to reveal levers.

Always ask: Who is affected and how often?

Qualitative Analysis: Themes and Root Causes

Open text is where reasons live. Follow a two-step approach:

- Manually sample verbatim to learn the common language.

- Scale with topic modeling or keyword clustering to surface recurring themes.

Prioritize themes by frequency and by their correlation with low scores. A single verbatim is useful. Patterns are decisive.

Prioritize Using Impact × Frequency

Plot issues by how often they occur and how much they drag down satisfaction. High-frequency, high-impact items are the top priority. Assign owners and deadlines.

Act: Close the loop and communicate change

Insights only matter when they drive action. Once priorities are clear, convert them into ownership and execution.

- Feed the top issues into process improvements, product tweaks, or training modules

- Share insights with product, operations, and marketing so feedback isn’t siloed

- Let respondents know their input made a difference

Then, measure the outcome. Did the change lift your CSAT or reduce complaints? Feed that data back into the system.

Using Feedback to Elevate Customer Experience

Insights are worthless unless they change behavior. Turning feedback into experience gains requires a tight loop and clear ownership.

1. Close the Loop Quickly and Visibly

Acknowledge low-score responses promptly. Triage by severity. Create an owner, a ticket, and an SLA for response. Fast acknowledgment shows customers they were heard. It also prevents escalation.

2. Translate Insights into Operational Fixes

Break fixes into three categories:

- Quick wins: UI copy changes, a canned reply, an FAQ update. Implement these within days.

- Process changes: Rework escalation rules, shorten approval steps, or change routing logic. Measure the effect.

- Product work: Use survey themes to inform the roadmap. Triage bugs vs. feature ideas; move high-impact fixes up.

Always attach a measurable goal to each fix (e.g., reduce repeat tickets by 15%).

3. Train and Enable Front-Line Teams

Use real feedback in coaching. Share anonymized good and bad verbatims in weekly huddles. Build micro-lessons for common failure modes. Empower agents with scripts, decision trees, and AI suggestions drawn from survey insights.

4. Align Leadership and Product Teams

Make feedback a governance input. Host weekly feedback reviews with service, product, and operations. Use consensus to convert top themes into roadmap items. Tie changes to business KPIs: retention, LTV, or support cost.

5. Communicate Outcomes to Customers

When you act, tell customers. A short note, such as “We fixed X after hearing from customers like you,” boosts trust and future response rates.

Measure impact continuously. If a fix doesn’t improve the targeted metric, iterate. Feedback-driven change is a cycle, not a project.

Common Pitfalls in Customer Feedback Surveys

Surveys can mislead if not run thoughtfully. Below are common traps and how to avoid them.

| What | Why | How (to fix them) |

| Survey fatigue | Too many asks lower response and quality | Reduce cadence, rotate questions, and target only relevant customers |

| Poor timing | Late or untimely surveys yield weak recall and low relevance | Trigger surveys at the moment of truth, immediately after resolution or a milestone |

| Leading or vague wording | Skewed or confusing questions produce unusable answers | Use neutral language and pilot questions with a small sample |

| Ignoring open text | Scores without reasons leave you guessing | Commit to analyzing open responses. Use sampling and automation to scale |

| No follow-through | Customers notice when feedback disappears into a report | Create an ownership model: triage → fix → update customer → measure |

Avoid these pitfalls by treating surveys as a workflow with clear owners, SLAs, and measurable outcomes. That makes feedback a source of momentum, not noise.

Top Tools for Collecting and Managing Customer Feedback Surveys

There’s no contesting the fact that customer feedback powers your CX strategy. And so, your choice of a customer feedback management tool matters. Here are five options to explore:

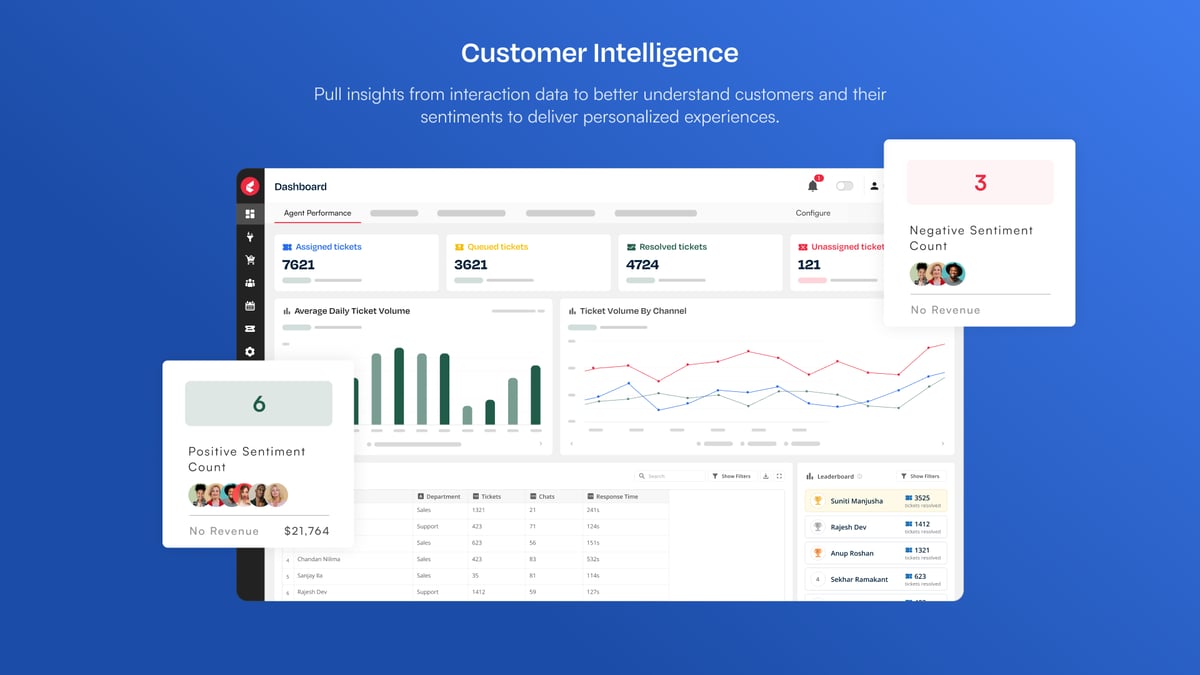

1. Kapture CX (AI-First Feedback & Survey Management)

Kapture CX makes feedback part of everyday service. It builds surveys right into your support workflow, so teams can capture customer sentiment in real time. Smart triggers send surveys after key interactions, while AI detects tone and patterns in responses.

The best part? Agents can see feedback next to tickets and act on it instantly.

Strengths

- Links survey data directly to tickets and interactions for instant context

- Detects sentiment and emerging themes automatically

- Escalates negative feedback through smart, rule-based triggers

- Unifies reporting by syncing across CRMs through APIs

Best For: Teams bringing support, analytics, and feedback onto a single AI-powered system.

G2 rating: 4.6/5

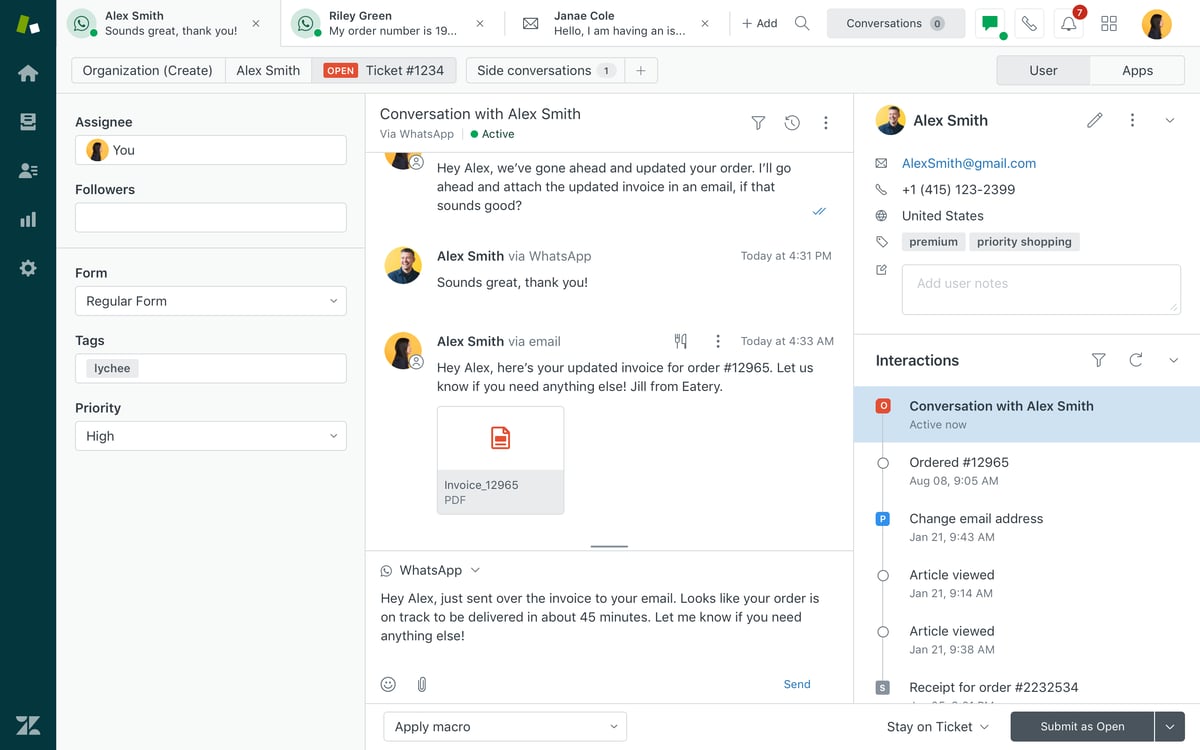

2. Zendesk (Built-in Feedback & Survey Module for Support)

Zendesk turns everyday support interactions into feedback moments. You can send CSAT or follow-up surveys automatically after a ticket closes and link every response to the right agent or channel. It supports star ratings, short text answers, or yes/no formats.

Strengths

- Automates survey triggers based on ticket status and outcomes

- Correlates survey results with agents, SLAs, and channels

- Offers flexible survey formats and response types

- Supports form customization and localization

Best For: Businesses already using Zendesk for an integrated and built-in survey automation.

G2 rating – 4.3/5

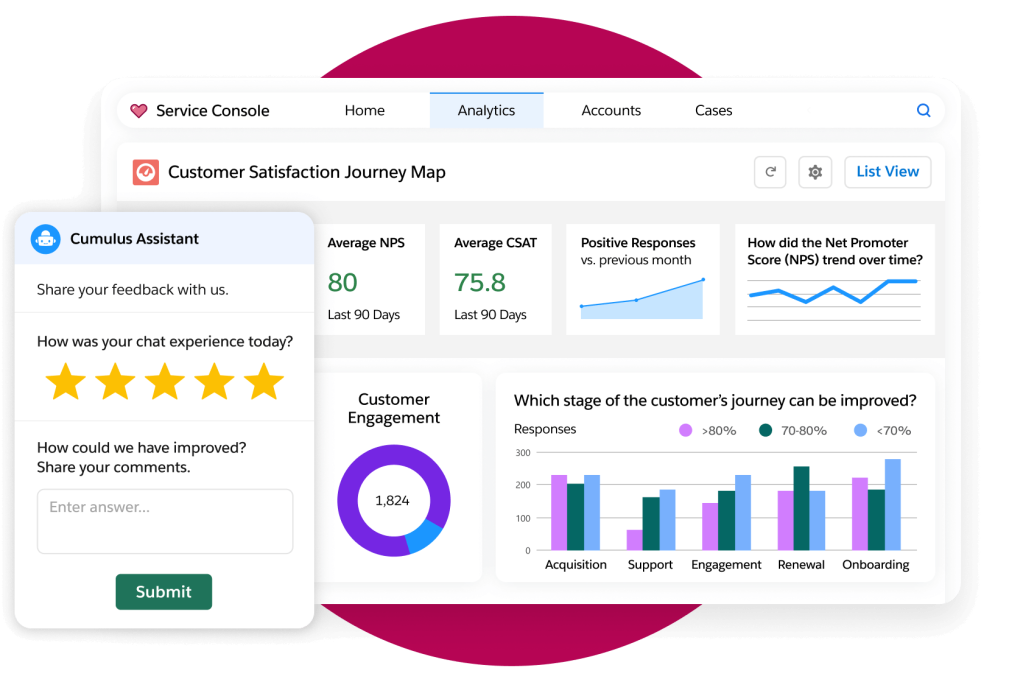

3. Salesforce (Service Cloud with Embedded Surveys & Feedback Tools)

Salesforce pushes customer feedback right onto the CRM and Service Cloud. Every response connects to a customer record, giving you context beyond the score. You can trigger alerts, create tasks, or update workflows when feedback comes in.

Strengths

- Attaches feedback directly to CRM profiles for complete visibility

- Automates follow-ups and workflows based on responses

- Blends service, sales, and feedback data into unified insights

Best For: Organizations looking to incorporate feedback into their Salesforce-driven workflows.

G2 rating – 4.4/5

4. Qualtrics XM (Experience Management & Predictive Analytics)

Qualtrics takes your customer survey data to the next level. It lends insights into what your customers are saying, and the rationale behind it. Plus, it keeps you ahead of the curve by spotting trends using survey logic, journey mapping, and analytics.

Strengths

- Predicts churn risks with advanced modeling and analytics

- Maps entire customer journeys to reveal experience gaps

- Benchmarks results against industry data

Best For: Enterprises looking to use customer experience as a strategic differentiator.

G2 rating – 4.3/5

5. Medallia (Enterprise Feedback & Voice of Customer Platform)

Medallia brings your business where your customers are. Whether it is stores and call centres or apps and websites. It turns all that feedback into alerts, helping teams act fast when something’s off. It also shows what’s driving satisfaction or frustration behind the scenes.

Strengths

- Unifies experience and operational data to identify root causes

- Flags key issues instantly with real-time signal detection

- Shortens response times via in-platform alerts and escalations

Best For: Large, multi-channel businesses that need a single CX visibility hub.

G2 rating – 4.5/5

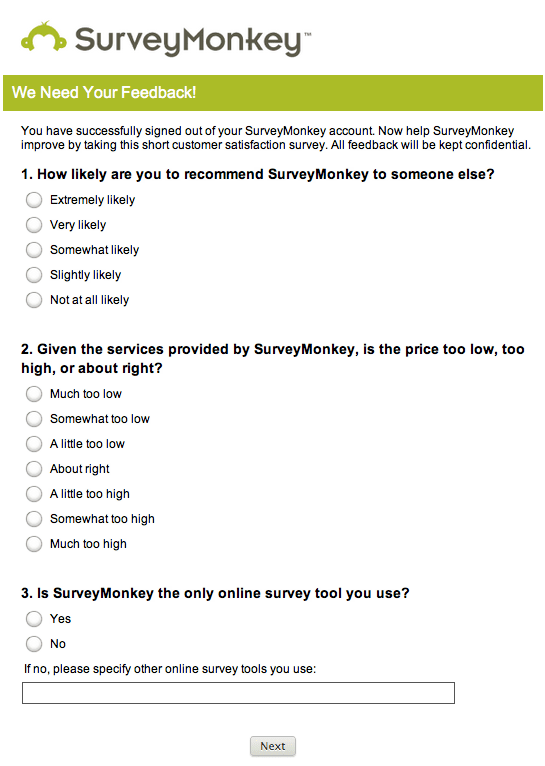

6. SurveyMonkey (Intuitive No-Code Customer Surveys)

Need to create quick and easy surveys? There’s SurveyMonkey. It sports a simple, no-code interface, helping you launch feedback forms in minutes. Plus, there’s ready-to-use templates for standard use cases. Connect with CRMs and centralize customer feedback data.

Strengths

- Offers drag-and-drop tools and templates to simplify survey creation

- Works seamlessly with various CRMs and support platforms

- Displays feedback trends through simple, actionable dashboards

Best For: Small or growing teams that want insights fast without technical setup.

G2 rating – 4.4/5

7. Typeform (Conversational & High-Engagement Surveys)

Find short, friendly, and conversational surveys to be more on-brand? Try Typeform. Its design keeps people engaged and more likely to finish. You can add logic so the next question changes based on each response.

Strengths

- Engages conversationally to improve completion rates

- Fits seamlessly into websites, apps, or chat windows

- Uses conditional logic and branching for real-time adaptation

Best For: Brands that value experience-led, high-engagement feedback collection.

G2 rating – 4.5/5

Emerging Trends in Customer Feedback Surveys

Customer feedback surveys have evolved with changing customer expectations. And they’ve also shaped the customer experience. You could lose more than half of your client base to a competitor after a single unsatisfactory experience.

Here’s a snapshot of what’s about to come:

1. Embedded, Context-Aware Feedback Everywhere

Say goodbye to standalone post-interaction surveys. Feedback prompts will soon be embedded within experiences. You’ll see them as in-app micro-surveys, voice assistants pausing to ask a quick question, or AR/VR interfaces prompting feedback in immersive spaces. The idea is to capture sentiment exactly when a customer reacts.

2. From Reactive to Predictive Feedback Systems

Feedback systems will no longer wait until customers report issues. Instead, platforms will forecast dissatisfaction before it surfaces. By analyzing usage, support logs, behavior patterns, and subtle sentiment signals, AI models will flag customers likely to churn, drop satisfaction, or escalate support. You’d intervene before the survey arrives.

3. Hyper-Personalized & Dynamic Surveys

Gone are superficial blanket surveys. Tomorrow’s surveys will adapt in real time, skipping irrelevant questions, probing deeper when sentiment is weak, or customizing phrasing based on customer history, persona, or past feedback. AI will generate or adjust questions dynamically to maximize relevance and reduce fatigue.

Imagine a survey that knows you just encountered a billing error, and adjusts accordingly: “We noticed unusual charges. What part of billing confused you?” The questions evolve as you answer.

4. Emotion & Intent Detection at Scale

Beyond sentiment (positive or negative), future systems will capture nuance: frustration, hesitation, confusion, delight. Voice tone, pause patterns, micro-expressions (in video), and lexical cues will all feed into a richer emotional profile. This helps feedback systems not just capture “what” customers say, but how they feel.

AI models that combine emotion recognition with intent detection will enable deeper diagnostics, such as “This person is not just unhappy, they are considering leaving.”

Building a Customer-First CX Strategy with Feedback

Customer feedback surveys are drivers of continuous improvement. They form the bridge between customer voice and richer experiences.

But impact comes from what happens next. The differentiator lies in how you structure, analyze, and convert insights into action. Operationalizing the collected data is the key to success. They close the loop fast, adapt in real time, and build experiences that keep customers hooked.

That’s where Kapture CX helps you lead.

Our AI-driven feedback and CX automation platform unifies customer insights, automates response workflows, and delivers a single source of truth across teams. From real-time survey analytics to action triggers, it turns customer responses into measurable business impact.

Ready to elevate your CX game? Book a free demo and see how feedback can fuel your next big leap.

FAQs

For transactional surveys (CSAT, CES), send within 24 hours of interaction resolution. It’s when the emotions are still fresh.

For relational surveys (NPS), choose stable points (quarterly or at renewal). This allows the customer to share more holistic feedback.

Keep it minimal. For transactional surveys, 1 scale question + 1 open prompt is optimal. For NPS or experience surveys, 5–7 questions is a safe maximum. Longer surveys drastically reduce completion rates.

Average response rates hover around 33%. But the format, timing, and channel matter. You can see much higher responses for a well-crafted, perfectly-timed survey.

Sample when volume is high to avoid fatigue. But ensure your sample is representative. So, stratify by region, product, and channel. For low volume, survey every eligible customer.

Don’t change core metric questions (CSAT, NPS) too often. You want a consistent baseline. But rotate open-ended follow-up prompts every 6–12 months to explore new pain areas.