Insurance agents deal with various tasks and clients in a single day. From calling prospects to closing deals to scheduling appointments, they have got a lot on the platter.

It is possible that agents might miss out on important tasks if their work processes are not managed properly in a streamlined manner. To avoid such circumstances, you need an insurance CRM software that adds value to your organization.

CRM for insurance agents helps them in managing clients, policies, and other important data.

In this blog, we bring you to a CRM solution that keeps insurance agents in focus by streamlining their work process. Continue reading to find out the best CRM software for insurance agents and how to choose the right one.

What is an Insurance CRM?

An insurance CRM software is a smart solution that addresses the specific needs of insurance agents and organizations. It organizes your operations, manages multiple policies in a single system, and automates assignments to the right person or team.

An effective CRM for insurance companies helps write a success story. It allows you to provide a customer-centric experience by continuously helping agents with the evolving needs of their customers.

You win in many ways when you decide to invest in a CRM for managing your operations.

Here are the major benefits of implementing insurance CRM software in your practice.

Benefits of CRM for the Insurance Sector

As per industry research, BFSI accounts for 22% of the global CRM software market.

This shows that with the rise in digitalization, insurance companies have taken a step ahead from the traditional customer service methods to CRM.

Mentioned below are a few benefits of using a CRM for insurance agents.

1. Enhanced Customer Experience

Your insurance agents mostly rely on personal relations to convert their prospects into customers. Therefore, customer retention becomes crucial for them as it profits more than generating new businesses.

So you need to enhance customer satisfaction by keeping up with their demands which will eventually lead to customer loyalty.

CRM for insurance agents benefits customer engagement by efficiently organizing the collated data of customers with the interaction data. This makes identification of the next steps for customers and agents easy and accurate and thereby, improves the customer experience.

2. Strengthened Data Security

Insurance is a data-driven sector that deals with huge amounts of data. Securing such a humongous volume of data is a big responsibility. This is one of the core concerns of today’s customers too. They are eager to know how your company is dealing with their data.

To mitigate this challenge, modern CRM solutions come up with built-in data security measures. An efficient insurance CRM software ensures that there is no risk of unauthorized access to data.

3. Manual Task Automation

It is difficult for your insurance agents to maintain a balance between the crucial task of meeting customers and managing documentation at the same time.

Also, it is not possible for agents to travel from place to place to collect documents while processing the policy issuance.

To simplify this process, CRM for insurance agents allows your customers to submit the documents online. Besides, agents can automate the auditing of such documents. This saves a significant amount of time and reduces the risk of errors, thereby increasing your agent’s efficiency.

4. Improved Communication

For agents, working with multiple customers and not letting the efficiency in the coordination get diluted is a challenge in itself. To address this challenge, insurance CRM software brings a resolution by staging all the important data of interactions with multiple customers in conjunction- with a single dashboard.

The dashboard illustrates insights from the interaction data to help the agents define the next steps conveniently. At the same time, agents can also send reminders to customers for renewals from the dashboard. This improves the CSAT score and helps in earning customer loyalty.

5. Personalized Experience

Offering a personalized experience to customers will make them feel special and they will get to know that you are investing time to understand their requirements and needs.

88% of customers prefer personalized approaches from their insurance providers.

By implementing an insurance CRM software, you can gain access to important insights about your customers like the age of their family members, number of dependents, etc.

Based on such information you can refer to insurance policies that can actually help them, instead of just trying to sell generic policies. This extensive degree of personalization can play a vital role in boosting your customer experience.

Major CRM Essentials for Insurance Companies

Simply choosing a customer relationship management platform is not enough for your agents to become more efficient. Instead, you need to ensure that the platform you are using is truly suitable for your business.

To do so, check if your CRM offers the following features;

1. Omnichannel Framework

Offer compelling and enjoyable customer journeys by streamlining your customer service processes and complex workflows. To do so, you need to integrate an omnichannel framework that is easy to use for agents and eliminates process workarounds.

It allows you to serve all your customers and their needs – from claiming to renewing policies across all channels. It also unifies the entire customer interaction history on a single dashboard so that you can add value to their experience.

The insurance CRM software with an omnichannel feature helps you with a unified view of customer data and optimizes your communication efforts with the customers.

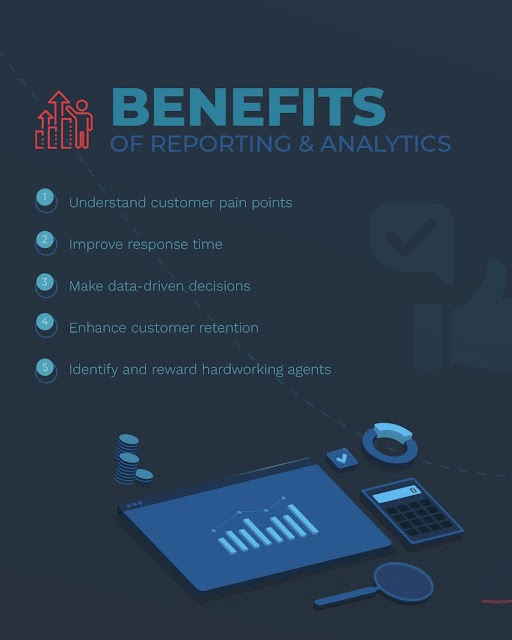

2. Reports and Analytics

The second must-have feature in insurance CRM software is the ability to generate reports and provide analytics.

Reporting and analytics tools allow you to get quick insights into the performance of your business-related initiatives. Hence, user-friendly dashboards that accurately summarize all of the most important information are invaluable.

Besides letting you visualize data seamlessly, a CRM should also generate detailed reports of performance trends and customer behavior monitoring. It enables you to take care of customer demands quickly and efficiently.

3. Seamless Integrations

There are various challenges associated with building an effective CRM software for insurance agents. Integrating multiple platforms to work together coherently is one of them.

Therefore, it is crucial that the CRM you are using must have the ability to integrate with other solutions your agents use.

For example, if you want to handle all communication activities and document processing in a single window – you will need a document management system integrated with your CRM.

You can also integrate WhatsApp to ensure two-way communication with your customers and offer instant responses to their queries, thereby increasing your customer experience.

4. Knowledge Management System

An efficient Knowledge Management System (KMS) helps you to organize knowledge access across the team. You can store all the up-to-date information in easily accessible formats and distribute it to a large number of audiences.

KMS works as a one-stop centralized knowledge base for the whole team and helps your agents in the process of gathering, storing, identifying, and sharing all the necessary information.

With a knowledge management system saving and sharing long-form content and information is just like taking something from an organized catalog.

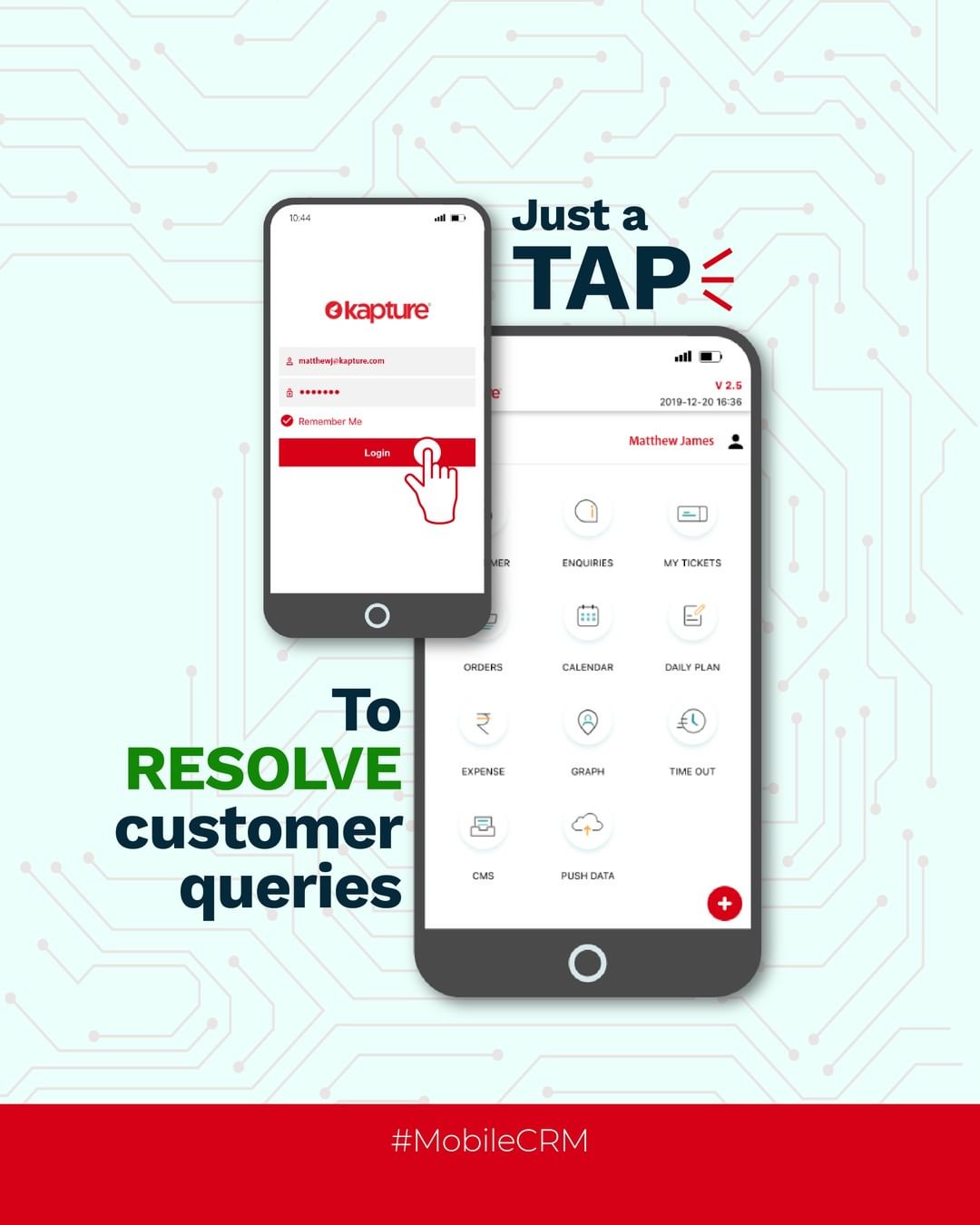

5. Mobile App

Lastly, it is important that your solution is mobile-friendly. With continuous evolution in the field of technology, it is now high time to expand your horizons and work without limits with Mobile CRM.

With information readily available at the fingertips, your agents can assist customers from anywhere.

Thus, utilizing a CRM that offers the same functionality on the mobile phone as on the web, is of utmost importance to boost the efficiency of your agents and the long-term success of your insurance company.

Acquire the Right CRM Solution

Insurance agents have a lot to gain from CRM software that is effective and easy to use. Whether you want to optimize existing workflow processes, centralize business initiatives, or get comprehensive customer behavior insights, a CRM is here to help.

Kapture offers a unique perspective to insurance companies by streamlining your operations with time-saving software designed to increase your agents’ efficiency.

Manage your customers, policies, and other tasks with integrated operations management.

Pull out detailed reports of your every business activity with 500+ reporting formats and use the data to optimize your business performance.

Automate your workflow to save your agents’ time on repetitive tasks and allow them to focus more on other important business activities.

Explore our service CRM solution at Kapture by connecting with the product squad and building lasting relationships with your customers.

About the Author | |

| Shivika |

| Shivika is a Content Writer at Kapture CRM, who enjoys using her creative skills to contribute to the exciting technological advances. She is passionate about cultural artifacts and culinary art. | |

,

,

,

,

,

,

,

,

,

,

,

,

,